Raise A Tax Query

NRI Tax Compliance Services: Navigating Tax Regulations for Global Indians

Tax compliance can be a complex process for Non-Resident Indians (NRIs) and Overseas Citizens of India (OCI). Understanding the intricacies of Indian and international tax laws is crucial to ensure compliance and avoid potential penalties. In this blog, we’ll explore the significance of NRI tax compliance services and how they can help NRIs navigate their tax obligations efficiently.

Understanding NRI Tax Compliance

NRIs face unique tax challenges due to their dual residential status and income earned both in India and abroad. Indian tax laws are stringent, and failure to comply with them can result in severe penalties. Many NRIs find it difficult to manage tax liabilities related to rental income, capital gains, or even savings account interest. Professional NRI tax compliance services provide expert guidance to manage these issues, helping NRIs stay compliant while optimizing their tax liabilities.

Why Do NRIs Need Tax Compliance Services?

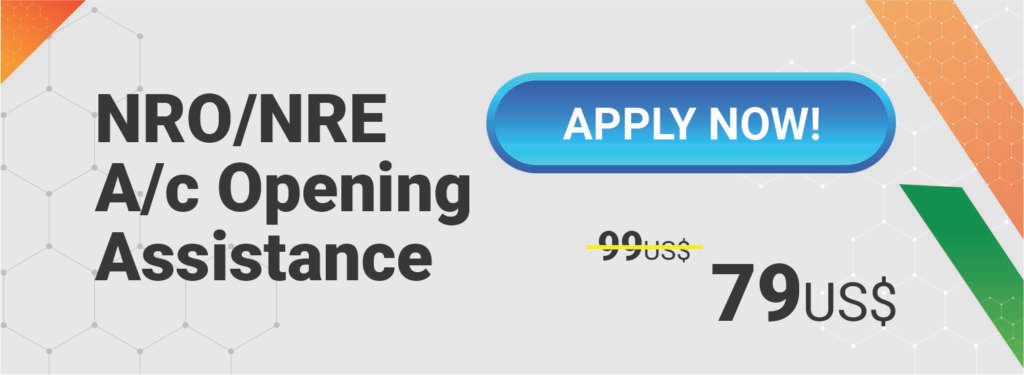

Tax compliance services for NRIs offer specialized support to ensure adherence to Indian tax regulations, including determining residential status, identifying taxable income sources, and filing income tax returns. NRIs may also need assistance with compliance for assets held in India, remittance declarations, and availing of applicable tax benefits. An experienced tax advisory service can make the difference between smooth tax filing and facing potential legal complications.

Key Areas Covered in NRI Tax Compliance

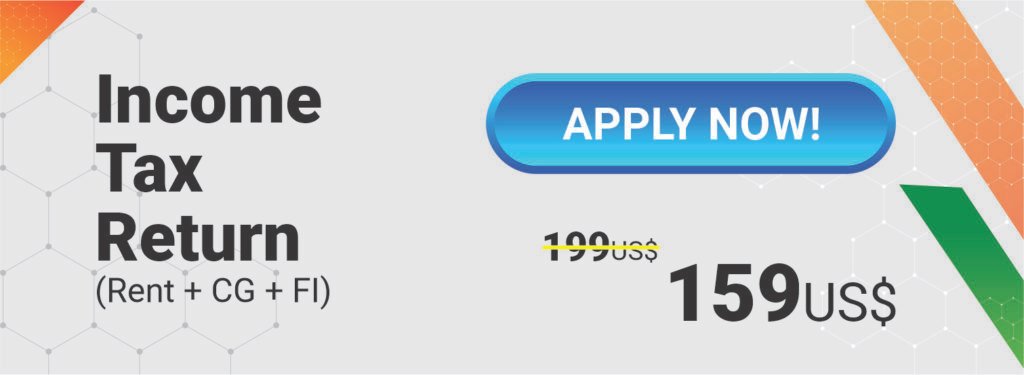

- Income Tax Filing: Help with filing income tax returns, declaring Indian income, and claiming deductions.

- Double Taxation Avoidance: Guidance on utilizing Double Taxation Avoidance Agreements (DTAA) to reduce tax liability.

- Capital Gains Management: Assistance with reporting and minimizing capital gains taxes on property sales or investments in India.

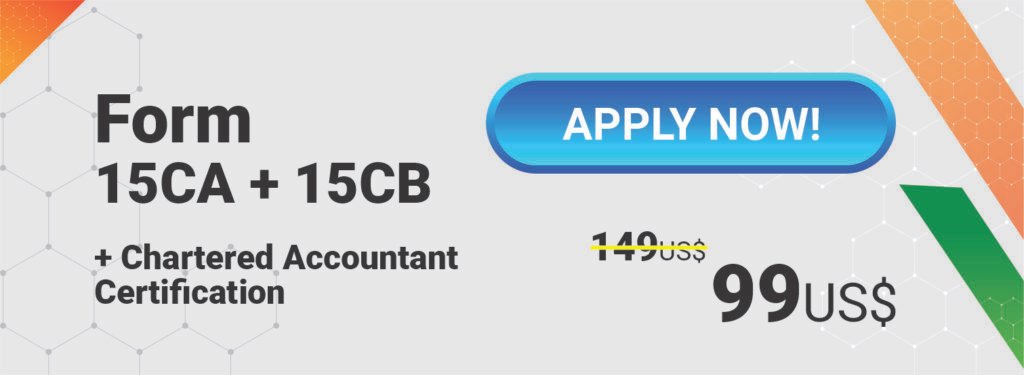

- Compliance with Reporting Requirements: Ensuring compliance with reporting financial assets and foreign remittances to the Indian tax authorities.

Common Tax Compliance Challenges for NRIs

- Determining Residential Status: Misinterpretation of residential status can lead to incorrect tax filings and penalties. Understanding residential status is critical, as it determines what part of the income is taxable in India.

- Double Taxation Issues: NRIs often face double taxation on the same income in both their resident country and India. Proper use of DTAA provisions can help mitigate this.

- Tax on Investments: Income from investments such as stocks or property in India needs careful management to minimize tax outgo and avoid non-compliance.

Benefits of Choosing NRI Tax Compliance Services

- Expert Advice: Professional services provide specialized knowledge of Indian and global tax laws, helping NRIs make informed decisions.

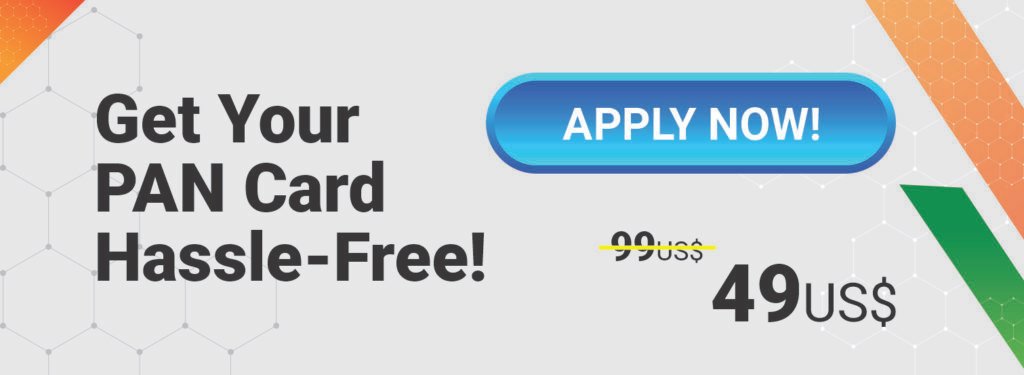

- Hassle-Free Compliance: Services include preparing and filing tax returns, ensuring accuracy, and avoiding delays or penalties.

- Personalized Solutions: Customized tax planning to reduce tax liabilities and enhance compliance with changing tax regulations.

Why Choose NRIHelpLine for NRI Tax Compliance

NRIHelpLine offers comprehensive tax compliance solutions tailored to meet the needs of NRIs and OCIs. With a team of seasoned experts in Indian and international tax laws, NRIHelpLine simplifies tax compliance for NRIs by providing personalized support, ensuring timely tax return filing, and resolving any issues with Indian tax authorities.

Conclusion

Navigating tax compliance as an NRI can be challenging, but with the right support and guidance, it’s possible to stay compliant and optimize your tax liabilities. NRIHelpLine’s expert services make tax compliance straightforward and hassle-free. Get in touch with us to explore how we can assist you in managing your NRI tax obligations effectively.

Why Should NRIs Choose NRIHelpLine for Their Tax Compliance Needs?

NRIHelpLine is a one-stop solution for all NRI tax compliance needs, with a dedicated team of experts who understand both Indian and international tax regulations. Our services include tax planning, filing, and advisory to optimize tax liabilities. We provide personalized assistance, handle complex cross-border tax scenarios, and ensure compliance with the latest tax amendments. With NRIHelpLine, NRIs can avoid penalties, minimize tax outgo, and receive end-to-end support in managing their tax matters effortlessly.

NRIs have to pay taxes on income earned or accrued in India, such as rent, capital gains, or interest on fixed deposits. They may also need to comply with specific reporting requirements, such as filing an income tax return if their income exceeds the taxable limit or if they want to claim a tax refund. NRIHelpLine simplifies the process by determining residential status, identifying taxable income sources, and ensuring compliance with Indian tax laws, reducing the risk of errors and penalties.

Yes, NRIs can claim several tax deductions in India, such as those under Section 80C for investments like ELSS, life insurance premiums, and principal repayment on home loans. They can also claim deductions under Section 80D for health insurance premiums and under Section 24(b) for home loan interest. NRIHelpLine offers expert guidance on how to optimize deductions, ensuring that NRIs take full advantage of applicable tax benefits while complying with Indian tax laws.

Non-compliance or failure to file tax returns in India can result in penalties, interest on unpaid taxes, and even legal proceedings. The Income Tax Department may issue notices or initiate scrutiny for non-filing, especially if the NRI has reportable income or financial assets in India. NRIHelpLine helps NRIs stay compliant by managing timely tax return filing, handling notices, and providing professional representation during any interactions with tax authorities, ensuring peace of mind.